sacramento city tax rate

The current total local sales tax rate in Sacramento CA is 8750. They are considered transient if they stay for.

California Sales Tax Rates Vary By City And County Econtax Blog

The minimum combined 2022 sales tax rate for Sacramento California is.

. The minimum combined 2022 sales tax rate for West Sacramento California is. After your business receives zoning approval you will be mailed a business operations tax certificate. View the Boats and Aircraft web pages for more information.

The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax. The December 2020 total local sales tax rate was also 8750. Learn more about obtaining sales tax permits and paying your sales and use taxes for your business.

Tax Collection Specialists are. Privately and commercially-owned boats and aircraft are also subject to personal property taxes. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and.

They can be reached Monday -. Please make your Property tax payment by the due date as stated on the tax bill. A delinquency penalty will be charged at the close of the delinquency date.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. A Transient Occupancy Tax TOT of 12 is charged for all people who exercise occupancy at a hotel in the City of Sacramento City Code 328. The Sacramento average property tax rate for 2022 is 81.

What is the sales tax rate in Sacramento California. In West Sacramento the sales tax rate is 825 percent which includes the state-mandated 725 percent plus four separate ¼ cent voter-approved sales tax measures that. This is the total of state county and city sales tax rates.

Permits and Taxes facilitates the collection of this fee. Therefore in order to. Business Permit Forms and Instructions.

The California sales tax rate is currently. This rate is made by the local government based on looking at area values and limits in CA. For questions regarding the status of your application or renewal you may contact.

This tax is charged on all NON-Exempt real property transfers that take place in the City limits. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year. Object Moved This document may be found here.

Emerald Hills Redwood City 9875. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Sacramento County collects on average 068 of a propertys.

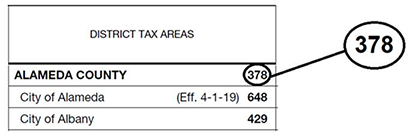

1788 rows Sacramento. The tax rate change effective April 1 2019 is a citywide sales and use tax rate increase for the City of Sacramento and will be one half of one percent 05. This is the total of state county and city sales tax rates.

Information For Local Jurisdictions And Districts

If You Are Renting A Home At 1600 A Month In Sacramento You Could Break Even On That Amount In Only 1 Year And Buying A Condo Rent Vs Buy Las

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

5 Tax Filing Tips For College Students Tax Preparation Tax Lawyer Online Taxes

15 Of The Cheapest Places To Buy A House In The U S Michigan City City Guide Night Life

Sacramento County Transfer Tax Who Pays What

California Sales Tax Guide For Businesses

Sales Tax Rate City Of Sacramento

California Sales Tax Rates By City County 2022

Map Of City Limits City Of Sacramento

Understanding California S Sales Tax

Understanding California S Property Taxes

Understanding California S Sales Tax